FICO, which is the developer of the most used score by most lenders, said that’s a first. FICO scores have a range of 300 to 850 – the higher the score is, the better the credit.

A credit score has a huge impact on one’s life. The score is used to determine the interest rate that consumers will pay for mortgages, car loans, personal loans or credit cards or if they’ll even be approved.

When the housing bubble burst, leading to a rise in foreclosures, the average credit score dropped to 686. FICO Vice President for Score and Analytics Ethan Dornhelm said those numbers have crept up higher since that time. He said the scores have hit an all-time high.

Dornhelm said a 700 score is considered as “very good credit,” with consumers getting the credit they want at affordable terms.

However, he said, there’s been a steady creep in both credit card balances and delinquencies, which is something the agency will need to watch out for.

4 Ways To Raise Your Credit Score

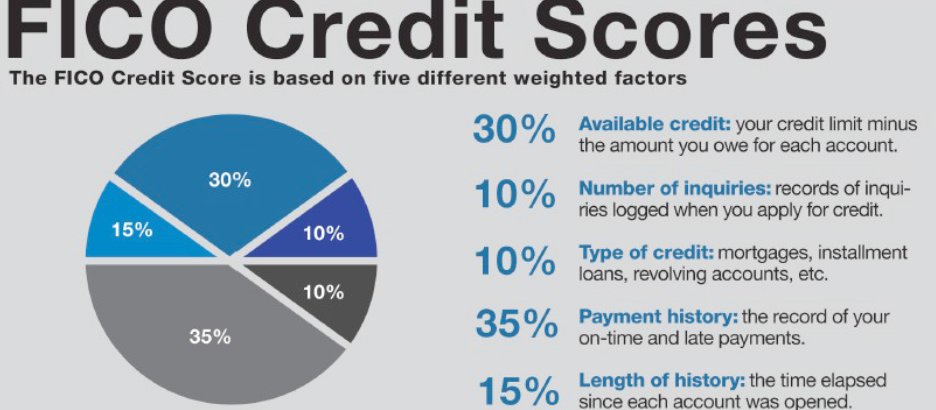

Your credit score is a culmination of information in your credit report file. It’s important to note that there is more than one credit score that lenders can use including TransUnion, Equifax, FICO, VantageScore, etc. Your score is always changing based on the information being reported in your credit file, lender customizations and software.

- 750+ is Excellent credit

- 700 – 749 is Good credit

- 650 – 699 is Fair credit

- 600 – 649 is Poor credit

- 600 or less is Bad credit

Make Timely Payments – To keep your credit score up, you need to make your payments on time. Just one late payment can drop your credit score by 60 points.

Don’t Overuse Credit Cards – Try not to use any more than 30% of your credit card limit. The higher your credit card usage, the lower your score.

Paying Your Debt Down – Instead of shifting debt from one credit card to another, start paying on it to pay it off.

Keep A Close Eye On Your Credit File – According to the Federal Trade Commission, 20% of consumers have wrong information in their credit file that is impacting their score. Be sure to keep an eye on your score often. There are several free services that can be used, but they only give you a general idea of your score.